Business Insurance in and around San Francisco

Calling all small business owners of San Francisco!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to keep track of. It's understandable. State Farm agent Mary Zell Spellman is a business owner, too. Let Mary Zell Spellman help you make sure that your business is properly insured. You won't regret it!

Calling all small business owners of San Francisco!

Helping insure small businesses since 1935

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your salary, but also helps with regular payroll costs. You can also include liability, which is critical coverage protecting your company in the event of a claim or judgment against you by a third party.

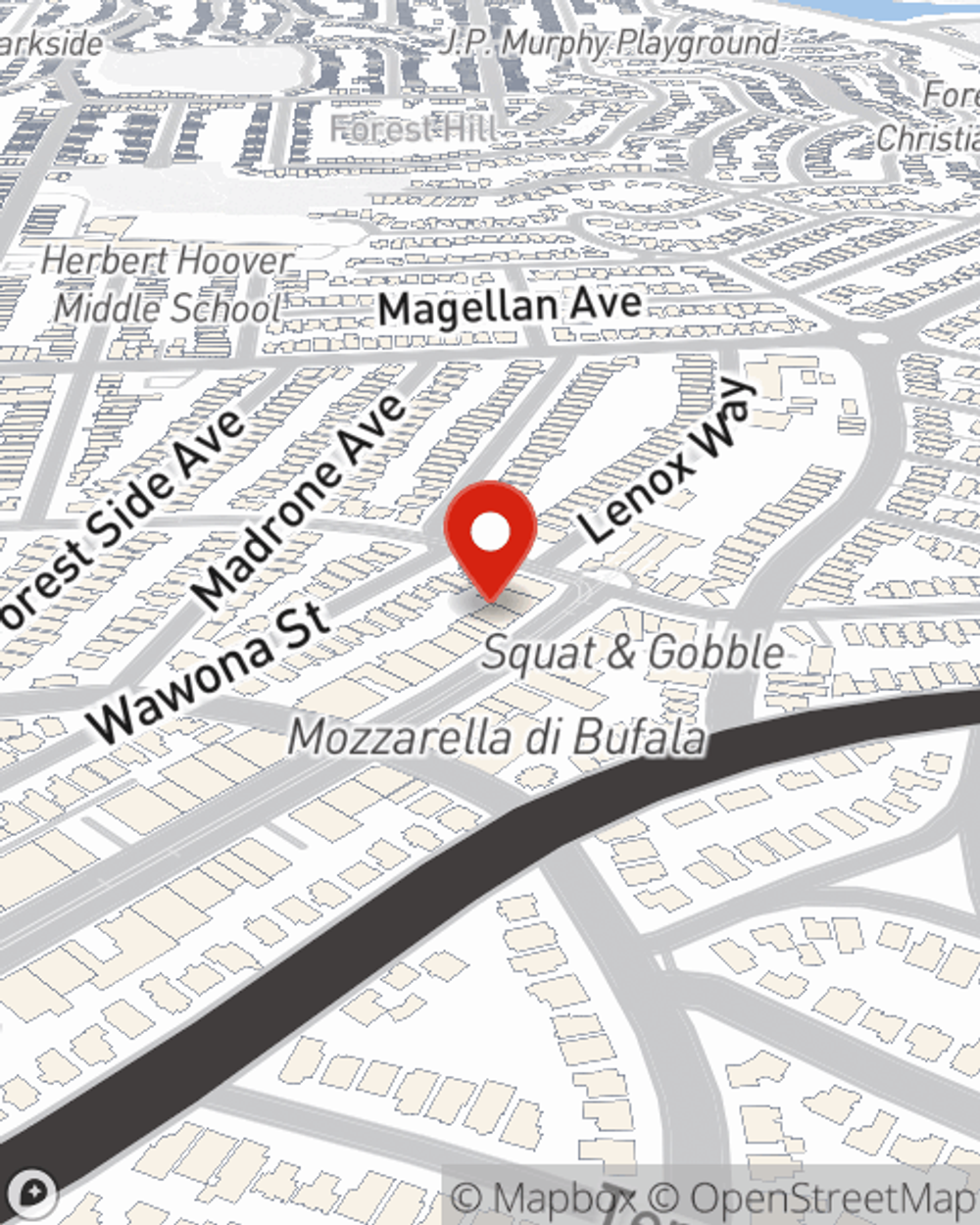

At State Farm agent Mary Zell Spellman's office, it's our business to help insure yours. Reach out to our outstanding team to get started today!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Mary Zell Spellman

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.